خلاصہ: The Fed Is Poised To Cut Interest Rates & Markets Will Go Much Higher

Today’s Letter is brought to you by Arch Public!

Unlock unparalleled returns with Arch Public’s algorithmic trading tools. Our Bitcoin Algorithm Arbitrage Strategy has delivered an astounding 247% annual return over the past three years.

The entries, and exits speak for themselves; precision that drives success. Trusted by more than 15,000 customers and industry leaders, we’ve partnered with Gemini, Kraken, Coinbase and Robinhood to bring you cutting-edge solutions.

Whether you’re a seasoned investor or just starting, our proven strategies maximize your potential. Join the ranks of those who trust Arch Public to navigate the markets with confidence.

Talk to us today and discover why our expertise sets us apart.

To investors,

Today’s Federal Reserve meeting is the talk of finance. The central bank has been behind the curve for months. They previously prided themselves on being “data dependent,” but earlier this year there was a subtle pivot in strategy and the Fed began trying to predict future inflation levels.

The big fear in the first half of 2025 was tariffs were going to create significant inflation. This was the excuse the Fed used for explaining why they were not cutting interest rates. If that inflation was likely to show up, the Fed’s logic would have made sense.

But it was obvious from the beginning that higher inflation was not going to happen. Unfortunately, the Federal Reserve’s transition from data dependence to market predictor prevented them from making good monetary policy decisions.

Thankfully, the Fed has now been backed into a corner. They can’t ignore reality anymore. Instead of talking about inflation concerns, the Fed has found the new boogeyman: the labor market.

Rather than admit they were wrong in their prior predictions, Jerome Powell and his crew are simply saying “the labor market is forcing us to change our mind.” Smart strategy from the central bankers. They never have to admit a mistake and claim victory on addressing a weak labor market.

There are a few important things to pay attention to today though. The biggest thing in my opinion is how strong guidance on future rate cuts will be. I don’t expect the Fed to say how many cuts, nor how large the future cuts will be, but given the economic data trends it would make sense for them to commit to continued rate cuts at the next few meetings.

Mohamed A. El-Erian doesn’t expect this to happen though. He writes “the Federal Reserve will deliver the widely anticipated 25 bps cut and signal the impending end of QT. It is also likely to acknowledge that the inflationary pass-through of tariffs has been less than expected. The world’s most powerful central bank is unlikely, however, to explicitly validate the additional cuts that markets have priced in or fully embrace the significant productivity upside from AI and other innovations.”

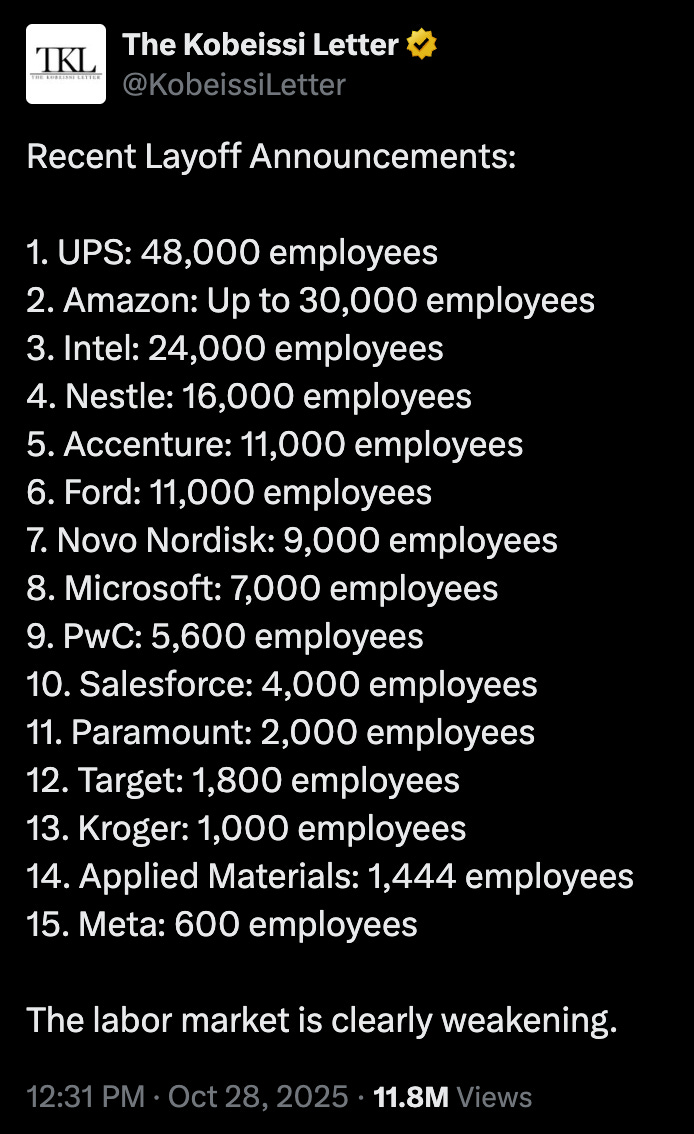

This approach would be surprising to me because it seems so obvious that the labor market is getting smacked in the face by technology forces. Just look at the recent layoff announcements by many companies that are actively implementing artificial intelligence and automation throughout their business.

You rarely see more than 100,000 employees being laid off when stocks are hitting all-time highs, companies are reporting record earnings, and year-over-year growth rates are accelerating. This explosion of productivity is coming as a direct result of technology making companies more efficient, which will only continue in the coming years.

So the Fed can ignore technology all they want, but it won’t change reality. And the reality is that interest rates will have to continue falling in order to address the labor issues.

So this brings us to the most important question for investors…where will the market go from here? What should we expect with asset prices?

Carson Group’s Ryan Detrick reminds us the past 21 times the Fed cut interest rates with the S&P 500 within 2% of an all-time high, stocks were higher a year later 21 times.

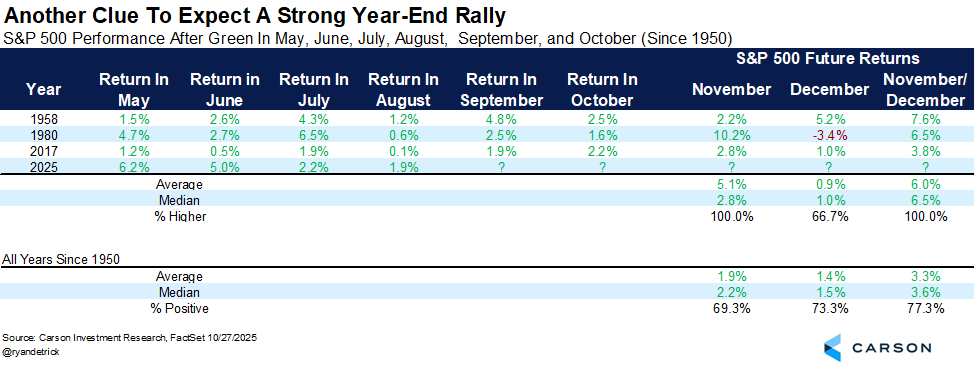

Ryan also goes on to explain “the last two months of the year (November and December) have never been lower when the S&P was up the six months leading up to them. In fact, the avg return was a very impressive 6.0%, nearly double the avg return for the usually bullish last two months.”

So my big takeaway is Powell and the Fed are going to play their usual game of word salad. They will create drama and the media will eat it up like a soap opera. But none of that is going to matter. As long as we get the rate cut, stocks and bitcoin are going higher. There is nothing the pessimists and doomsday predictors can do about it.

Markets like cheap capital. Investors love interest rate cuts into bull markets. And we are likely to get both later today.

Have a great day. I’ll talk to everyone tomorrow.

– Anthony Pompliano

Founder & CEO, Professional Capital Management

Why “Crypto” Will Be Dead In 10 Years

Anthony and John Pompliano break down today’s markets — from DeFi and stablecoins reshaping finance to the U.S.–China trade deal and its impact on investors.We also discuss why sentiment is turning bullish, how to think about bitcoin and gold heading into year-end, and what White House Asset Management’s moves signal for the market.

Enjoy!

Podcast Sponsors

-

Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

-

Arch Public – Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)

-

Defi Development Corp – DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.

-

easyBitcoin – Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.

-

Bitlayer – Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs

-

Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.

-

Bitwise Asset Management – Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

-

Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.

-

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/

-

Core – Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

-

BitcoinIRA – Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

-

Zkverify – A modular blockchain dedicated to efficiently verifying zk proofs across diverse blockchain stacks.

🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.